Opening an SDIRA can present you with entry to investments Usually unavailable via a bank or brokerage organization. Here’s how to begin:

Even though there are many benefits associated with an SDIRA, it’s not with out its own negatives. Many of the frequent reasons why traders don’t pick SDIRAs include things like:

An SDIRA custodian differs given that they have the suitable staff members, know-how, and potential to maintain custody of the alternative investments. The first step in opening a self-directed IRA is to locate a company that is definitely specialized in administering accounts for alternative investments.

Complexity and Duty: Having an SDIRA, you may have a lot more Manage around your investments, but You furthermore mght bear much more accountability.

The tax advantages are what make SDIRAs interesting For several. An SDIRA could be the two common or Roth - the account sort you select will rely mostly with your investment and tax approach. Check out along with your economic advisor or tax advisor in case you’re Doubtful that's finest for you.

Due Diligence: It can be named "self-directed" for just a purpose. By having an SDIRA, you will be fully accountable for extensively investigating and vetting investments.

Believe your Buddy may be commencing the following Fb or Uber? By having an SDIRA, you may put money into leads to that you suspect in; and potentially delight in larger returns.

Be in control of how you improve your retirement portfolio by utilizing your specialized information and pursuits to speculate in assets that healthy together with your values. Got experience in real-estate or personal equity? Use it to assistance your retirement planning.

As an Trader, on the other hand, your options are usually not limited to shares and bonds if you decide on to self-immediate your retirement accounts. That’s why an SDIRA can rework your portfolio.

When you’ve observed an SDIRA provider and opened your account, you could be wondering how to actually commence investing. This Site Comprehending the two The foundations that govern SDIRAs, and the best way to fund your account, may help to put the muse for a way forward for effective investing.

In case you’re searching for a ‘established and overlook’ investing tactic, an SDIRA almost certainly isn’t the appropriate alternative. Because you are in overall control about each and every investment built, it's up to you to carry out your personal research. Keep in mind, SDIRA custodians aren't fiduciaries and cannot make tips about investments.

Customer Guidance: Seek out a provider that provides focused help, including entry to professional specialists who can remedy questions on compliance and IRS principles.

Introducing money on to your account. Keep in mind that contributions are subject matter to once-a-year IRA contribution limits set because of the IRS.

The main SDIRA guidelines from the IRS that buyers have to have to understand are investment limits, disqualified people, and prohibited transactions. Account holders have to abide by SDIRA policies and rules in an effort to protect the tax-advantaged standing of their account.

Occasionally, the charges related to SDIRAs may be higher and more sophisticated than with an everyday IRA. It's because of the enhanced complexity connected to administering the account.

Array of Investment Alternatives: Make sure the company enables the types of alternative investments you’re enthusiastic about, for instance housing, precious metals, or non-public fairness.

Relocating money from one particular form of account to a different kind of account, like shifting money from a 401(k) to a traditional IRA.

Several traders are shocked to know that using retirement cash to take a position in alternative assets has been achievable due to the fact 1974. Even so, most brokerage firms and banking companies focus on providing publicly traded securities, like stocks and bonds, given that they absence the infrastructure and skills to handle privately held assets, including real-estate or private equity.

IRAs held at banking companies and brokerage firms supply limited investment selections to their consumers since they do not need the expertise or infrastructure to administer alternative assets.

Ashley Johnson Then & Now!

Ashley Johnson Then & Now! Mackenzie Rosman Then & Now!

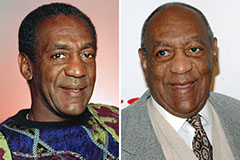

Mackenzie Rosman Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now! Bernadette Peters Then & Now!

Bernadette Peters Then & Now! The Olsen Twins Then & Now!

The Olsen Twins Then & Now!